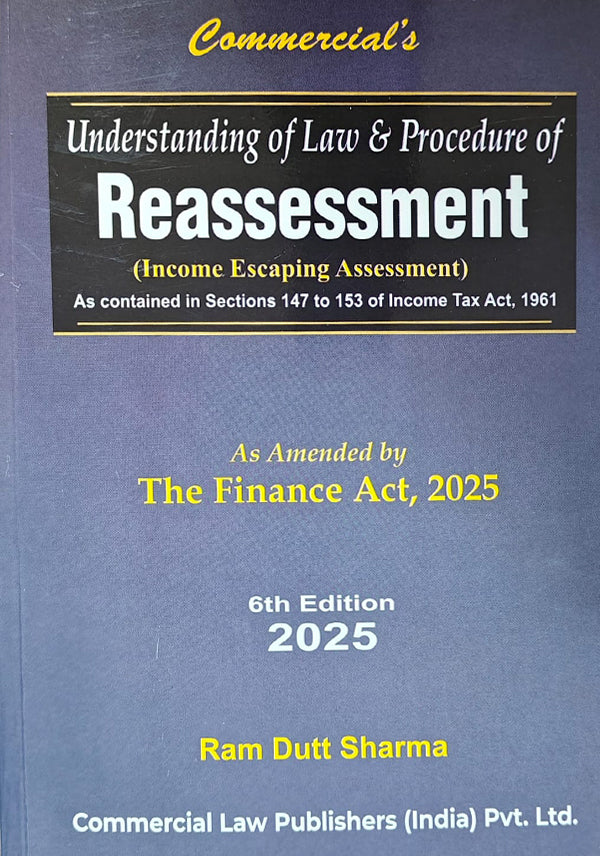

Commercial Law Publishers

Understanding of Law and Procedure of Reassessment

Understanding of Law and Procedure of Reassessment

Couldn't load pickup availability

Chapters

1. Introduction……………………………………………………………………………………. 1

2. Income Escaping Assessment [Section 147]…………………………………… 20

3. Issue of Notice Under section 148 where Income has Escaped

Assessment [Section 148 : As substituted by the Finance

(No. 2) Act, 2024, with effect from 01.09.2024]……………………………….. 41

4. Issue of Notice under section 148 Where Income has Escaped

Assessment [Section 148 : As applicable upto 31.08.2024]……………… 51

5. Issue and Service of Notice under section 148……………………………….. 85

6. Notices under section 148 barred by Limitation ……………………………. 99

7. Notice in the Name of Deceased Assessee in Reassessment

Proceedings…………………………………………………………………………………. 100

8. Reassessment – Notice Against Non-existent Entity – Validity…….. 119

9. Notice Deemed to be Valid in Certain Circumstances

[Section 292BB]……………………………………………………………………………. 124

10. Issuance of Notice Under Section 143(2) in Reassessment

Proceedings…………………………………………………………………………………. 132

11. Procedure before issuance of notice under section 148

[Section 148A : Applicable with effect from 01.09.2024] ………………. 138

12. Procedure before issuance of notice under section 148

[Section 148A : Applicable upto 31.08.2024] ………………………………… 142

13. Prior approval for assessment, reassessment, or recomputation

in certain Cases [Section 148B]…………………………………………………….. 201

14. Time Limit for Notices under Sections 148 and 148A

[Section 149 : Applicable from 01.09.2024]…………………………………… 203

15. Time Limit for Issue of Notice Under Section 148

[Section 149 : Applicable from 31.08.2024] ………………………………….. 205

16. Provision for Cases where Assessment is in Pursuance of

an Order on Appeal, etc. [Section 150]…………………………………………. 243

17. Sanction for Issue of Noticeunder Section 148 [Section 151]……….. 265

18. Faceless Assessment of Income Escaping Assessment

[Section 151A]……………………………………………………………………………… 287

19. Other Provisions [Section 152]…………………………………………………….. 306

20. Time Limit for Completion of Assessment, Reassessment

and Re-computation [Section 153]………………………………………………. 312

21. Effect of Re-opening the Assessment Based on Wrong Facts or

Conclusions…………………………………………………………………………………. 325

22. Reopening of Assessment and Maintainability of Writ Petition…… 331

23. Reopening beyond 4 years’ failure to disclose fully and

truly material facts necessary for assessment …………………………….. 342

24. Concept of Reason to believe ………………………………………………………. 356

25. Doctrine of Change of Opinion……………………………………………………. 378

26. Offences and Prosecutions…………………………………………………………… 398

27. Specimen of Reasons recorded for Reopening of Assessment……… 427

28. Important Board’s Circulars and Instructions……………………………… 429

29. Cases where Initiating Reassessment Proceedings Justified………… 447

30. Cases where initiating reassessment proceedings not justified……. 453

31. Cases where Reassessment Proceedings Justified on the Basis

of Informations Received from other Agencies……………………………. 473

32. Cases where Reassessment Proceedings not Justified on

the Basis of Informations Received from other Agencies …………….. 476

33. Important case law on Reassessment…………………………………………… 482