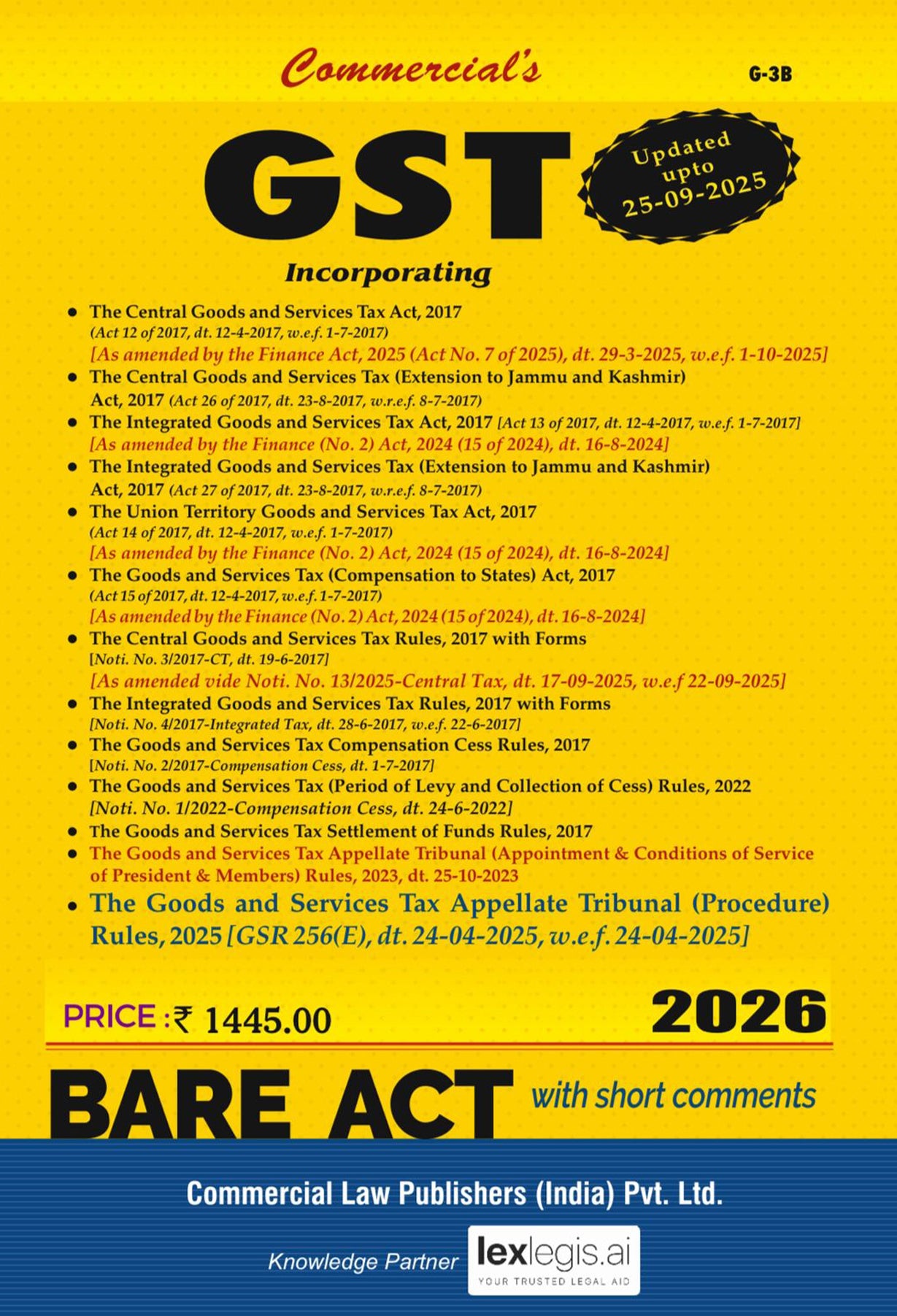

Commercial Law Publishers

GST Incorporating - Bare Act (2026 Edition)

GST Incorporating - Bare Act (2026 Edition)

Couldn't load pickup availability

GST Act & Rules – Index (Effective 25.09.2025)

GST Incorporating - Bare Act [ 2026 Edition]

Chapter 1: Preliminary – Pages 1–2

Chapter 2: Administration – Pages 16–17

Chapter 3: Levy and Collection of Tax – Pages 18–25

Chapter 4: Time and Value of Supply – Pages 26–30

Chapter 5: Input Tax Credit – Pages 32–42

Chapter 6: Registration – Pages 42–52

Chapter 7: Tax Invoice, Credit & Debit Notes – Pages 53–56

Chapter 8: Accounts & Records – Pages 57–58

Chapter 9: Returns – Pages 59–71

Chapter 10: Payment of Tax – Pages 71–81

Chapter 11: Refunds – Pages 81–86

Chapter 12: Assessment – Pages 87–89

Chapter 13: Audit – Pages 89–90

Chapter 14: Inspection, Search, Seizure & Arrest – Pages 91–95

Chapter 15: Demands & Recovery – Pages 95–109

Chapter 16: Liability to Pay in Certain Cases – Pages 109–114

Chapter 17: Advance Ruling – Pages 115–123

Chapter 18: Appeals & Revision – Pages 124–143

Chapter 19: Offences & Penalties – Pages 143–157

Chapter 20: Transitional Provisions – Pages 158–165

Chapter 21: Miscellaneous – Pages 169–186

Extension & Other Acts

CGST (Extension to J&K) Act, 2017 – Pages 192–193

IGST Act, 2017 – Pages 194–221

IGST (Extension to J&K) Act, 2017 – Pages 222

UTGST Act, 2017 – Pages 223–244

GST (Compensation to States) Act, 2017 – Pages 245–255

Rules

Central GST Rules, 2017 – Pages 261–803+

E-Way Bill Rules – Pages 414–429

Inspection, Search & Seizure Rules – Pages 431–432

Demands & Recovery Rules – Pages 432–444

Offences & Penalties Rules – Pages 444–447

IGST Rules, 2017 – Pages 1015–1026

GST Compensation Cess Rules, 2017 – Pages 1027–1028

GST (Period of Levy & Collection of Cess) Rules, 2022 – Page 1028

GST Settlement of Funds Rules, 2017 – Pages 1029–1078

GST Appellate Tribunal (Appointment & Conditions) Rules, 2023 – Pages 1080–1085

GST Appellate Tribunal (Procedure) Rules, 2025 – Pages 1092–1117